Help and support

FAQs for Financial advisers

Employers' responsibilities FAQs

No. These grants are intended to support business and their employees by covering up to 80% of the costs of employment up to an overall cap of £2,500 for each employee (depending on the level of non-working hours). The grant covers wages, but employers must pay National Insurance contributions and the minimum employer pension contribution of 3% of qualifying wages required under automatic enrolment.

The scheme has been extended until September 2021.

From July 2020 furloughed workers have been able to return to work part-time with employers being asked to pay towards the salaries of their furloughed staff.

Salaries of all furloughed workers, full- and part-time, remain pensionable.

Will these cover amounts beyond the automatic enrolment minimum?

No. In the interests of simplicity, the government has aligned the grants with the 3% minimum contribution required by employers under automatic enrolment. If employers contribute above this amount and will continue to do this for furloughed staff, they won’t be able to claim for these additional contributions.

If you’re still paying your employees, then you’re still required to make the deductions as normal. You must continue to pay your agreed levels of pension contributions ensuring they meet the statutory minimum of 8% contributions, paying at least 3% as an employer.

If you’re paying some staff, but not others, simply amend the relevant contribution amounts, gross pay and pensionable earnings columns to ‘0’ for those employees who haven’t been paid. Then upload the file as normal.

If you’re not paying any staff, please log on to Gateway and select the ‘Null submission’ option for the relevant payroll.

You should keep your Direct Debit active – there’s no need to cancel it.

There are statutory deadlines for paying contributions to us. You need to make sure pension contributions can be collected by the 22nd of the month after the deductions were made. This means you need to have uploaded the contribution details to us, and made sure your Direct Debit Instruction is up to date, well in advance.

Keeping on top of collecting and managing your contribution payments will ensure money is credited to members’ pension savings promptly.

What happens if my contributions are late?

The Pensions Regulator (TPR) is interested in all employers who pay contributions late. We’re legally obliged to monitor your contribution payments and report to TPR if contributions are more than 90 days late (or there’s some other significant payment failure). We also have to tell your employees.

The Pensions Regulator (TPR) is interested in all employers who pay contributions late. We’re legally obliged to monitor your contribution payments and report to TPR if contributions are more than 90 days late (or there’s some other significant payment failure). We also have to tell your employees.

Your participation agreement is the contract we have with all the employers who are part of our master trust. This agreement defines the terms of participation in our Scheme. It sets out the charges you pay as an employer, your payment schedule, the services we offer and the charges your Scheme members pay.

It also outlines your responsibilities to provide payroll data, contributions and contact details for you and your Scheme members.

If you want to make any changes to the agreement or you have any questions about how it works, please contact us.

You need to keep an up-to-date and accurate record of the following activities.

- The names and addresses of all the employees you’ve enrolled.

- Records of when you paid contributions into the Scheme.

- Employee opt-in and joiner notices.

- Your pension scheme reference or registration numbers.

- Information you’ve sent to us, as your workplace pension provider.

It’s important to keep these records in an easily-accessible format so you can prove to The Pensions Regulator, if asked, that you’ve met your auto enrolment duties. If you outsource your payroll management to an external provider, they must keep these records up to date and accurate for you. But you’re still legally responsible for ensuring these records are kept.

How long do I need to keep these records for?

You must keep your pension scheme reference or registration numbers, as well as any data you send to us, for six years. You need to keep your opt-out notices for four years.

Auto enrolment is an ongoing process. Once you’ve enrolled your employees into your workplace pension and they’re active members, you need to meet your ongoing responsibilities for the Scheme – including the following.

- Uploading accurate pension data files to your employer website every pay period.

- Making sure everything’s in place for contributions to be paid or collected on time.

- Checking that statutory employee communications are sent on time, including opt-in and opt-out confirmations, new joiner notices and re-enrolment communications.

- Monitor the age and earnings for new and existing employees every month to check their eligibility for auto enrolment.

- Re-enrolling eligible employees every three years.

- Keeping accurate records of all your auto enrolment activities.

Your payroll team or payroll provider is best placed to assess your employees’ eligibility for auto enrolment into your workplace pension. This can help speed up the process and reduce the risk of you missing contributions.

Please note, we don’t carry out employee assessments.

Yes. You must send each employee a ‘postponement notice’. This communication tells them:

- you’re postponing assessing them for auto enrolment to a later date known as their ‘deferral date’, and

- what their deferral date is.

If you’ve asked us to send your statutory communications you’ll need to have successfully uploaded your first CSV file (pension data file) showing the assessment category for each employee, before we can send postponement notices.

Yes. You can delay auto enrolment for some or all your employees by up to three months. This is known as ‘postponement’.

This could be useful if you have staff on short-term or temporary contracts who won’t still be working for you after three months.

You can also delay auto enrolment to align with your company accounting and payroll periods.

Postponing auto enrolment doesn’t affect your duties start date. If you decide to postpone auto enrolment, you must send postponement notices to each employee within six weeks of your duties start date. If you’ve asked us to send your statutory communications you’ll need to have successfully uploaded your first pension data file, showing the assessment category for each employee, before we can send postponement notices.

So even if you choose to postpone, you’ll need to have your workplace pension with us up and running by the time of your duties start date if you want us to send your statutory communications.

If any of your employees write to you before the deferral date and ask to join a pension scheme, you must put them in. If you put them into our Scheme, you’ll have to pay contributions on their behalf

The Pensions Regulator says it is your legal duty to write to all your staff individually about auto enrolment.

If we manage your statutory communications for you, we either send an email direct to the employee (if you’ve given us their email address) or we send you a PDF with their payroll number so you can send it to the correct employee.

Please encourage your employees to provide an up-to-date email address in their online member account. This enables us to keep them informed about their workplace pension.

Yes. We can send statutory communications to your employees, including entitled workers and non-eligible jobholders who don’t join the Scheme.

We don’t charge you extra to send this information by email – either direct to each employee, if you’ve given us their email addresses, or to a common mailbox managed by your HR or payroll department. They’ll be responsible for forwarding the communications to your employees.

You’re legally obliged to tell each individual employee about auto enrolment into a workplace pension scheme and explain how they will be affected by auto enrolment, including what they have to do and their choices. You must do this within six weeks of your auto enrolment duties start date.

If you don’t manage your communications promptly and effectively, you risk not meeting your auto enrolment duties.

If you ask us to manage your statutory auto enrolment communications (assessment, enrolment and postponement letters), we’ll send these communications for you.

For every payroll cycle after your duties start date you’ll need to upload a CSV file, containing details of your employees’ contributions and your contributions, to your employer website. This is your ‘pension data file’ (generic input file). If you’ve asked us to manage your statutory auto enrolment communications, uploading a pension data file will trigger tailored assessment, enrolment or postponement communications for each employee.

Before your next payroll cycle, download your employee action file to see information about employees who’ve opted in, opted out and left the Scheme, or changed their contribution rate. You’ll need to update your payroll with this information so it’s reflected the next time you upload a pension data file.

Your auto enrolment duties start as soon as you employ someone for the first time, even if it’s only one person. You have to set up a workplace pension and assess them for auto enrolment into it.

Not all your employees will be eligible for auto enrolment. But you still need to assess them as part of your auto enrolment duties, and send them an assessment notice telling them what their rights and options are.

The Pensions Regulator has a handy online checklist to help you work out what your duties are.

If an employee leaves their employment they stop being an active member of the Scheme (‘cease active membership’). They will no longer pay contributions and neither will you, as their employer.

You’ll need to put the employee’s leaving date in your pension data file before you upload it. This will close their record as an active member. We’ll send them a ‘leaver’ letter explaining the options they have for their pension savings in the Scheme.

You can’t amend the data for a pay period once you’ve finished importing your pension data file (generic input file). If you need to make amendments after a pay period has been processed, you’ll need to do this on the next file you upload for the following pay period.

If you upload the file and the system shows there are errors in the data, you’ll need to choose ‘Cancel and upload a new file’. Although you can simply edit your file and re-upload it, it’s best to fix this kind of error in your payroll software so it doesn’t recur.

If you do edit a file and re-upload it, remember to also amend the details in your payroll to make sure you upload the correct data in future payroll periods.

If the payroll period has been processed and you need to make amendments urgently, please call our client support team on 0330 100 3336 from 9am to 5pm, Monday to Friday (please be ready to give your four-digit employer code). We may record your call to help us improve our service to you.

Or, contact us by email at clientsupport@nowpensions.com. Please include your four-digit employer code in the email. This will help us to help you faster.

To ensure you don’t accidentally upload duplicate records to your employer website, check your employee records regularly and make sure you, or your payroll department, enter Payroll Codes and payroll numbers in a consistent way. This reduces the risk of split pension savings, multiple charges and mis-timed communications for your employees.

The first time an employee is listed on the file, your employer Gateway website will generate their unique NOW: Pensions contract ID. Most employees will only have one contract ID.

Other reasons for duplicates

Other common reasons for duplicate records include formatting issues within the CSV file, employees changing from one payroll to another or employees re-joining the company.

A Payroll Code is a four-digit code that distinguishes one payroll from another. You need to enter this code when setting up your payroll and uploading each pension data file.

We refer to the Payroll Code as PAYCODE in our file format.

If you need to create a new Payroll Code for your employer website, it must:

- contain four characters

- be alphanumeric (contain only letters and/or numbers)

- be case-sensitive.

If you need to add a payroll, set the Payroll Code to the next number in the sequence in the format P00x.

Here’s an example of Payroll Codes for an employer with six payrolls. If they needed to add another payroll – for example, for an office based in Glasgow – they would set the new Payroll Code as P007.

- P001 for monthly payrolls

- P002 for weekly payrolls

- P003 for temporary/casual staff

- P004 for permanent staff

- P005 – office based in London

- P006 – office based in Manchester You can find out more about Payroll Codes in step 4 of our employer Gateway user guide.

You can find out more about Payroll Codes in our employer Gateway user guide.

This is how often you run your payroll, for example: weekly, fortnightly or monthly.

You’ll need to select this from the drop-down menu when you set up a payroll.

We refer to the payroll frequency as PAYFREQ in our file format.

A pay period refers to the tax period in your payroll, for example, 1-12 for a monthly payroll or 1-52 for a weekly payroll.

You don’t need to create pay periods as these will automatically be created when you complete the first file import into your Gateway employer website.

You can edit pay periods by clicking on ‘Edit schedule’.

Please make sure you double-check that the pay period start date matches the values in the file you’re importing.

A pay period refers to the tax period in your payroll, for example: 1-12 for a monthly payroll or 1-52 for a weekly payroll.

You don’t need to create pay periods as these will automatically be created when you complete the first file import into your Gateway employer website.

We refer to the pay period as PAYPERIOD in our file format.

This is the latest date you plan to upload the final pension data file for a specific payroll. You’ll need to enter this date when setting up a payroll.

You can change the data in your file as many times as you need to before this date. You can’t make any changes to the pension data file (generic input file) after this date. You need to make sure all the data in your pension data file is correct and uploaded accurately, so please check your payroll and correct any errors well in advance of the processing date.

This is the first day of the pay period for your pension data file (generic input file). You’ll need to enter this date when setting up a payroll and uploading each file.

We refer to the pay period start date as PAYSTART in our file format.

Your ER Code, also known as your Company Code, is a unique four-character code which we use to identify your company when you sign your Participation Agreement with us.

You can find this in your Gateway employer website and on any communications we send you.

A PSR number is allocated to workplace pension schemes by The Pensions Regulator. It’s an eight-digit number starting with 1.

Our Pension Scheme Registry Number is 12005124. You’ll need this number to complete your Declaration of Compliance.

Once you’ve set up your workplace pension, you must declare to The Pensions Regulator (TPR) that your workplace pension is compliant and all the information you’ve provided is accurate.

You must declare your compliance within five months of your start date, or you may be fined. TPR recommends you do it as soon as possible. They have produced a checklist with all the information you need to send them and where you can find it. This includes the following.

- Your unique Employer Pension Scheme Registry (EPSR) number – this is your four-digit employer (ER) code.

- The Pension Scheme Registry (PSR) number for the NOW: Pensions Trust: 12005124

- Our address: NOW: Pensions Trustee Ltd, 6 Bevis Marks, London, EC3A 7BA

You can start your declaration of compliance here. TPR estimates it takes about 15 minutes once you have all the information to hand.

You’ll have auto enrolment duties as soon as you employ someone. This is known as your ‘duties start date’.

Some of your employees may not be eligible for auto enrolment, but you need to assess them as part of your auto enrolment duties from the day they start working for you. You’ll also need to send them an assessment notice telling them what their rights and options are.

The Pensions Regulator has a handy online checklist to help you work out what your duties are.

An EPSR is a unique identifier allocated to an employer by the trustees or managers of personal pension or multi-employer workplace pension schemes, to register with The Pensions Regulator.

Your EPSR number for the NOW: Pensions Trust (‘the Scheme’) is your employer code.

You can find this in your Gateway employer website and on any communications we send you. You’ll need this number to complete your Declaration of Compliance.

Employees can pay AVCs to top up their pension savings. They can do this by increasing the percentage they contribute each payroll, or by paying a one-off lump sum. Your employees can find out more about AVCs here.

A CSV file is a plain text file that lets you save data in a structured format. They’re often used to import and export data between different spreadsheet, payroll and accounting software packages. You’ll need to use CSV files when you’re uploading your pension data file and downloading your employee action file.

Remember, when you’re working with CSV files it’s easy to lose information (for example, payroll numbers which start with a zero). To help ensure your data is accurate, please follow these instructions:

- Only export files direct to Excel that are correctly formatted.

- Make any amendments before saving the file.

- Once the file’s complete, save as a .csv file and click ‘Yes’ to use that format.

- Close the document.

- When you’re prompted to save changes, click ‘No’. Your file is ready to upload.

If you need a blank CSV file, you can download one here.

Our system works with most payroll software. You need to submit accurate data to make sure you meet your auto enrolment duties by The Pensions Regulator’s deadlines. Speak to your payroll department or your payroll software provider to find out what systems they have in place to deal with auto enrolment, including assessing and communicating with employees.

You should upload your first file (generic input file) after your duties start date in line with pension regulations. Uploading your file before this date could trigger errors, such as:

- incorrect employee communications

- the wrong contributions being collected, or

- incorrect dates for employees’ opt-out windows.

You should upload your pension data file as soon as possible after your payroll processing date – but make sure all the information in it is correct and complete. We use this information to produce statutory employee communications for you and there are strict timescales, enforced by The Pensions Regulator, for sending these to employees.

When you’re managing data in your Gateway employer website, you use two different files: the pension data file (which you may see referred to as the ‘generic input file’) and the employee action file.

- Your pension data file is a CSV file populated with information about employee contributions from your payroll. You upload this to your employer website after every payroll run.

- The employee action file contains a list of all the changes employees have made since the last payroll run – for example, opting out or in, or changing their contribution rate. You need to download this file to see if there’s any action you need to take before the next payroll run.

It’s worth familiarising yourself with these file formats so you can manage your data accurately.

How the pension data file and employee action file are used

You upload your first pension data file following the first payroll run after your duties start date. You still need to do this even if you decide to postpone. Then at each pay period you’ll need to do the following.

Before the payroll run, download the employee action file from your employer website and update your payroll system with any changes, such as opt-outs or contribution rate changes.

Once you’ve run the payroll, download the pension data file from your payroll software and upload it into the employer website.

Repeat the same steps for every payroll cycle.

Check the files for errors

Mistakes and missing data in payroll files are a common cause of problems. Checking the pension data file for missing data such as dates of birth, email addresses or incorrect gross pay figures will help prevent errors and stop it being rejected.

Pension data file

The pension data file is a comma-separated value (CSV) file that drives everything. It’s used to:

- update the fields in the employer website to inform the Direct Debit collection

- highlight when to send statutory employee communications (if you’ve asked us to manage this for you), and

- log any changes to employee details such as joiners and leavers.

Please don’t alter the CSV file after you’ve extracted it from your payroll software. If you need to change any entries, make the changes in your payroll software and produce another CSV file.

If the files don’t match exactly it can cause problems with Direct Debit collections and employee communications.

Our handy guide explains how each column works in more detail.

Employee action file

The employee action file holds important information such as employee opt-out and opt-in dates. It also tells you if an employee has changed their contribution rate by making additional voluntary contributions (which doesn’t affect the amount of your employer contributions).

Download this file before each payroll run and make any changes before the next pay period closes. For example, if an employee has opted out within their one-month opt-out window, you’ll need to update this and process a refund of their contributions through your payroll. This will ensure no further contributions are taken.

Downloading your employee action file from your employer website

To access the employee action file, go to the home page and select ‘Payroll’.

From within the payroll screen, click on the ‘Download employee action file’ button.

You’ll need to check the employee action file before each payroll run to find out whether any employees have opted in or out, or increased their contributions. Although employees may also choose to tell you this information, they’re not required to.

Important columns in the employee action file

- Column H – OPT IN DATE

- Column J – OPT OUT DATE

- Column K – OO LASTDAY

- Column N – AVC RATE

We operate a net pay scheme. Pension contributions are deducted from employees’ pay and paid over to the Scheme before income tax is calculated.

You’ll need to:

- calculate pension contributions on gross (before tax) pay and

- work out your employees’ income tax after their pension contributions have been deducted.

As a result your employees who are taxpayers won’t pay any income tax on their pension contributions. They automatically get full tax relief.

Employees who don’t earn enough to pay tax don’t normally get tax relief – but we’ve set up our Scheme so they don’t miss out. We have a tax top-up scheme so employees who don’t pay tax can claim tax relief and have it added to their pension savings in the Scheme. (Employees must claim this themselves – it’s not something you can do on their behalf as their employer.)

What other types of tax relief are there?

There’s another type of tax relief arrangement called relief at source. In this kind of scheme, the employer must deduct 80% of employees’ pension contributions from their take-home pay (after income tax has been taken off).

The pension scheme claims the tax relief from HM Revenue & Customs (HMRC) each month and pays it back to the employee. HMRC only sends back the basic rate of tax: 20%.

Higher or additional-rate taxpayers can claim back the rest of the tax relief from HMRC either by writing to them separately, or through their annual self-assessment tax return.

These include all an employee’s earnings for that pay period including wages, commission, overtime, bonuses, performance-related pay and any other earnings.

Basic earnings include earnings before deductions, holiday pay and statutory pay such as maternity, paternity, adoption and sick pay. The workplace can exclude some elements of pay such as bonuses, overtime, commission and some allowances.

The whole of a worker’s basic earnings count for working out auto enrolment contributions. So, if you chose our auto enrolment standard 102 plan for a worker with basic earnings of £20,000, you would use the whole £20,000 to work out their pension contributions.

These are all earnings between a lower and upper limit set by the government and reviewed each year. Qualifying earnings include salary, wages, commission, bonuses, overtime, statutory sick pay and statutory parental leave pay (maternity, paternity and adoption pay).

In 2024-2025 the lower limit is £6,240 and the upper limit is £50,270. Earnings below the lower limit and above the upper limit don’t count for working out auto enrolment contributions.

So, if you chose our auto enrolment standard 101 plan for a worker earning £25,000 including all their bonuses, you would use only £18,760 to work out their pension contributions. (£25,000-£6,240 = £18,760).

This is a structure for your pension contributions. Our contribution models range from a simple, low-cost standard plan that meets the minimum requirements, to more generous plans with matching contributions for those who want to offer a workplace pension that’s competitive as well as affordable.

If you don’t see what you need, please call us on 0330 100 3336 (Mon to Fri, 9am-5pm), as we can offer customised plans.

| Contribution model code | Definition of pensionable earnings | Contribution levels |

| 101 | Qualifying | 3% employer and 5% employee |

| 102 | Basic | 4% employer and 5% employee |

| 103 | Basic | 6% employer and 3% employee |

| 104 | Basic | Total contributions of 10% or more |

| 105 | Basic | Flexible rates starting at 4.5% for employer and employees |

You can choose to work out contributions in a way that meets one of three alternative sets of requirements. See The Pensions Regulator’s guidance on certifying schemes for more about this.

Your Gateway employer website is where you upload your pension data files (the generic input file) – CSV files with information about your employees – to support the administration of your workplace pension. Before you can upload your first file there are a few steps you’ll need to follow, which will take about 30-45 minutes.

Payroll set-up

The key to your workplace pension running smoothly is providing accurate and up-to-date data from your payroll system.

First, before your duties start date, contact your payroll provider to let them know you’ve chosen NOW: Pensions as your auto enrolment provider.

Then, check your payroll provider can produce the CSV files – the pension data files/generic input files – in the correct format. If not, you may need to work with them to ensure the data can be produced in the correct format.

Here are a few points to remember.

- NOW: Pensions operates a net pay scheme where contributions are deducted from employee’s gross (before tax) pay. You’ll need to make sure your system is set up to do this.

- If you’re using postponement, remember to include the date your postponement ends in your pension data file.

Once you’ve set up your employer website, you’ll need to enter the following information into your payroll software.

- Your Employer Code (also known as a Company Code) – this will be pre-populated in the Employer Details section of your employer website.

- Your Payroll Codes – you’ll need to set up a separate code for each payroll you have.

Logging in

Around two working days after we approve your application, we’ll send three emails to your appointed payroll contact.

- A unique link to your employer website.

- A separate email with your password.

- Another email to guide you through the tasks that you need to complete, such as initial set-up of your website, preparing your pension data file, uploading pension data, making payments for Scheme members and keeping the website up to date.

First, log in to your Gateway employer system using the login name and password details in the emails you received. When you first log in, you’ll be asked to change the password. Please remember, only click the save button once, as double clicking invalidates the new password.

- Your initial login name is the email address of your primary payroll contact.

- Your initial password is the email address of your primary contact.

Choose your contribution model (Scheme tier)

We offer a range of contribution models (Scheme tiers) designed for the needs of different employers, from a simple low-cost plan that meets minimum requirements to more generous plans.

Verify your company details

When you’ve logged in, click on ‘Company Details’ on the left-hand menu, and check all your details are correct. This page shows the information you provided during the application process.

Confirm whether you want us to send communications

- Next, tick the box if you want us to send out statutory auto enrolment communications to your employees. Sending these by email is included in our charges.

- We can send them to your employees on your behalf, but you will need up-to-date email addresses for all your employees. We’ll also need a central mailbox email address to receive any communications that come back as ‘undeliverable’. You’ll need to put this into the ‘mail box address for emailed PDFs’ text box. Most employers use a generic HR or payroll email address as their central mailbox.

- Or, we can simply send them to your central mailbox for you to pass on to your employees.

The Pensions Regulator (TPR) reference

Add your TPR reference (also known as a letter code). This is a 10-digit number unique to every employer. It begins with a ‘1’. You can find your it on the top right-hand corner of all your letters about auto enrolment from TPR.

Once you have checked all the details, select the save button.

If you can’t find your TPR reference, please contact them on 0845 600 1011 or email them providing the following information:

- employer name

- PAYE scheme reference(s)

- employer address

- your contact details (telephone number, email address, job role).

Create additional logins

If you need other members of staff to access your website, add them now. Click on ‘Admin Login’ on the left-hand menu and fill out the fields.

You should only select ‘Employer’ as the User Role.

You can add more users later.

Add payroll groups

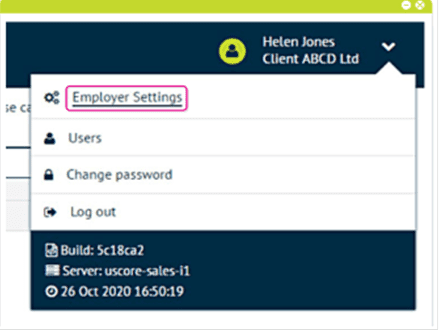

To add a payroll group, go to the Employer settings page:

Scroll down to the payroll information section and click ‘Add payroll’:

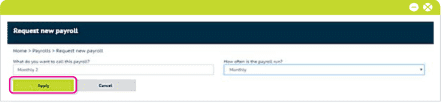

Enter the display name for the payroll group, its frequency and click ‘Apply’:

As contributions are collected according to payroll group, you’ll need to download a Direct Debit form. Print out the instruction form, complete it (ensuring it’s signed and dated correctly) and email it to us at directdebit@nowpensions.com.

Note that the status is set to ‘Pending’. You won’t be able to upload a pension data file for this new payroll group until we’ve received the Direct Debit form.

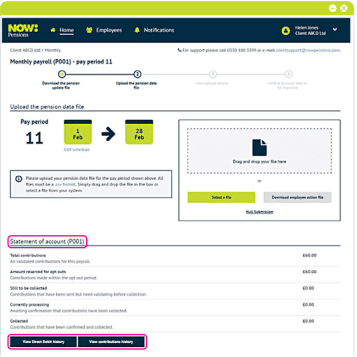

Checking your Statement of account, Direct Debit and contributions history

Go to the Employer payroll page. You can see all the contribution-based information there:

Click through these options to get more detailed information. Remember that contributions are only collected once employees are out of their opt-out window (you can see this information by clicking on ‘Amount reserved for opt outs’ above).

No. If you’re paying employees, you must continue to make employer contributions at the agreed levels ensuring you meet the statutory minimums (3% for employers) and deduct employee contributions (5%) to meet the minimum requirement of 8%.

Where you’ve already paid staff and deducted contributions, you’ll need to continue to upload your pension data and allow the collection to be made.

No. You mustn’t advise or encourage employees to opt out of your workplace pension scheme. This could be considered an inducement and would be a breach of your legal duties. We’re obliged to monitor this and report any such incidents to TPR.

Yes. Automatic enrolment legislation requires Statutory Sick Pay (SSP) to be treated as part of qualifying earnings.

During sick leave, pension contributions paid by both employers and employees are based on the employee’s actual earnings.

So unless the contract of employment or the workplace pension scheme rules offer more generous terms, both employer and employee contributions will decrease if sick pay is less than normal pay.

If you’re paying some staff, but not others, simply amend the relevant contribution amounts, gross pay and pensionable earnings columns to ‘0’ for those employees who haven’t been paid, then upload the file as normal.

If you’re not paying anyone, please log on to Gateway and select the ‘Null submission’ option for the relevant payroll.

You should keep your Direct Debit active – there’s no need to cancel it.

The Pensions Regulator (TPR) has been explicit that it expects employers to continue making contributions to workplace pension schemes. If you’re having difficulty paying your pension contributions, you need to consider when you’ll be able to make up any missed payments and, if necessary, contact us to agree a payment plan to bring your contributions up to date.