In April, auto enrolment minimum contributions increased from 2% of qualifying earnings to 5% as part of the phased roll out of the policy.

For auto enrolled savers paying in the minimum each month, this meant that their contributions tripled from 1% to 3% while employer contributions doubled from 1% to 2%.

To put that in context, somebody earning £27,000 a year would have seen the amount they were paying into their pension go from around £17 every month to £52. But, at the same time, the amount their employer paid in also increased from £17 to £35.

Research we carried out just ahead of the increase suggested that 84% would carry on paying into their workplace pension after the increase but, in fact, many more have continued to save.

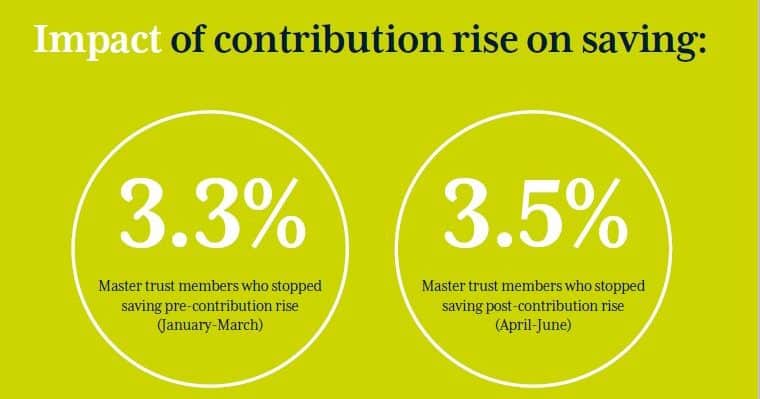

Encouraging figures released by the Pensions and Lifetime Savings Association for the three largest master trusts (that’s NOW: Pensions together with NEST and The People’s Pension) show the proportion of people who stopped contributing to their pension increased by just 0.2 of a percentage point in the months after April.

Before contributions rose, in the three-month period between January and March, the average proportion of members stopping saving was 3.3%. In the three months after the contribution increase (April – June), the average proportion was 3.5%.

This means that for every 1,000 savers, just 35 a month have decided to stop saving.

All this suggests the impact of higher contributions on savers’ behaviour has been much smaller than anticipated – a big relief for all concerned. In part this was because the Chancellor was kind to us, and changes in tax, National Insurance and minimum wage rules have helped to offset the impact of higher pension contributions in pay packets.

But, there’s no room for complacency as in April 2019, contributions will rise again with members’ contributions going from 3% of qualifying earnings to 5% while employers increase from 2% to 3%.

The success of auto enrolment is reliant on savers remaining in their schemes and the government, providers and employers must continue to drive home the benefits of pension saving.

We’re still a long way from being able to confidently declare “job done”. But, for now at least, we can confidently say “so far so good!”

Adrian Boulding, Director of Policy, NOW: Pensions