The 2024 gender pensions gap report

The effects of the gender pensions gap multiply during a working life. Its impacts are felt in retirement, where 67% of pensioners in poverty are women. Put simply, the gender pensions gap is a whole life issue.

The 2024 gender pensions gap report finds:

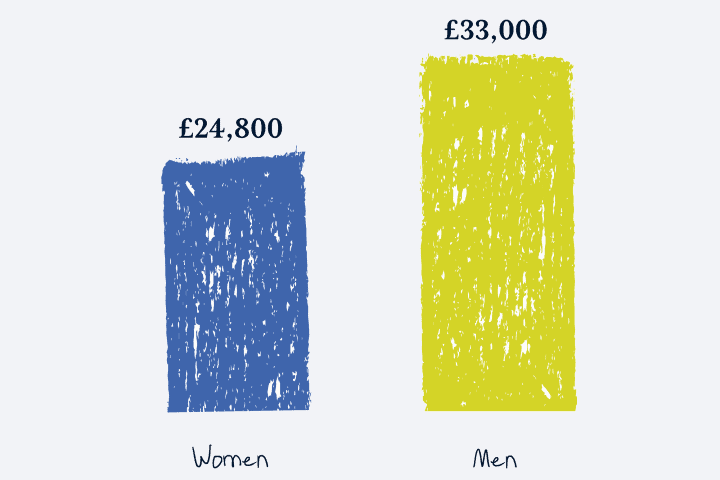

- Today, women retire on average with pension savings of £69,000, compared to £205,000 for men.

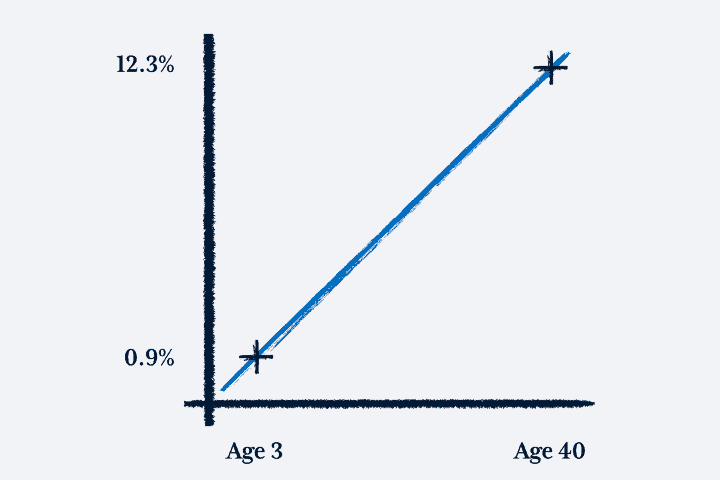

- In order to close this gap, a girl would need to start pension saving at just three years old, to retire with the same amount of money as working men.

- Career gaps owing to childcare and other factors result in an average ten-year career gap for women, amounting to £39,000 in lost pension savings.