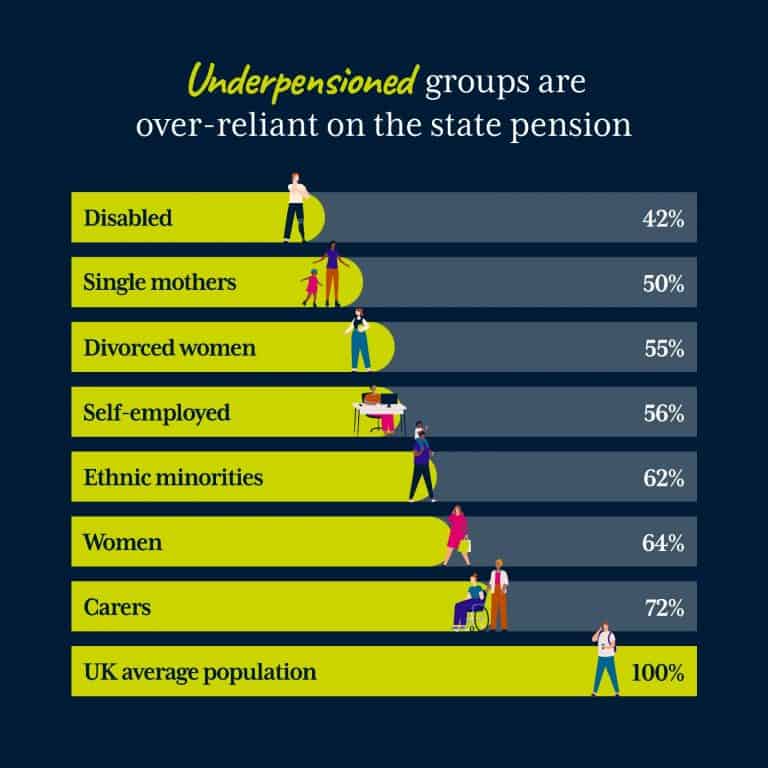

Since our last published report two years ago, the pension wealth gap has worsened. Underpensioned groups are retiring with 85% less than the UK average.

We are proposing two key policy changes that will help these groups increase pension wealth by an average of 30-52%.

Underpensioned groups are reaching retirement age with a pension wealth approximately 15% of the UK average.

Our policy proposals would help get a further 2.5 million involved with pension saving, generating an additional £1.2 billion in annual pension contributions.