The Statement of Investment Principles (SIP) sets out how NOW: Pensions invests members’ pension savings. The SIP includes the Trustee’s investment beliefs, objectives and policies.

We also publish an annual Implementation Statement that sets out how we follow, review and update the SIP during the Scheme Year.

Background

The SIP is reviewed at least once every three years, and when there’s a significant change in investment policy. Our recent investment strategy review finished in September 2023 and is now in effect.

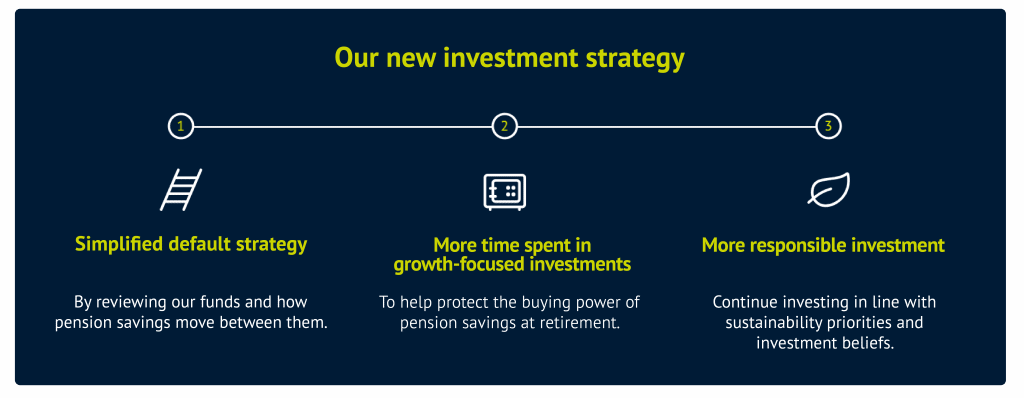

Our investment strategy

1. Simplified default strategy

The updated investment strategy makes it easier for members to understand how their savings are invested.

2. More time spent in growth-focused investments

We expect most members to take their pension savings as a lump sum. Our default strategy is designed to protect the buying power of savings as members approach their planned retirement age. To give members’ savings longer to grow, we’ve reduced the time it takes for their savings to move between the Diversified Growth Fund (DGF) and the Retirement Countdown Fund (RCF) by five years. This change will allow savings to stay growing for longer.

3. More focus on responsible investment

We continue to improve our investment strategy to deliver value for members, and invest responsibly, in line with our sustainability priorities and investment beliefs.

Download our Statement of Investment Principles (September 2023).

Our latest annual Implementation Statement covers the Scheme year to 31 March 2023. Download our latest Implementation Statement (March 2023).